Can you describe what quantitative-risk technology entails?

In today’s global financial markets, managing risk has become a very complex business activity that requires the use of sophisticated analytics to understand and predict how the bank’s credit portfolio will behave under different macroeconomic scenarios. Quantitative-risk technology enables the bank to run multiple Monte-Carlo simulations using massive parallel computers and to stress the portfolio under different macroeconomic conditions.

At what point in your professional development did you decide this is what you wanted to do?

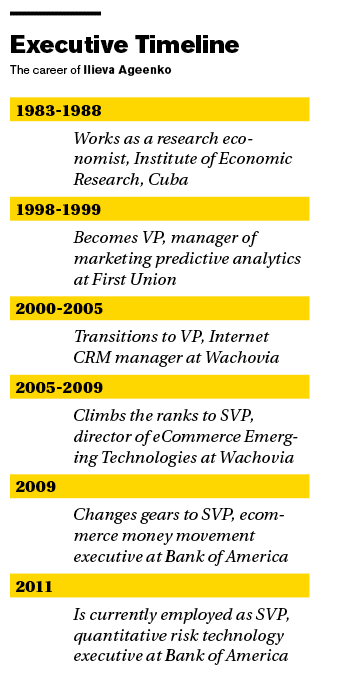

I have a background in mathematical economics and many years of leadership experience managing technology and a global workforce. However, until now, I never had a true opportunity to use all these skills at the same time. The closest I came to [doing] that was about 10 years ago when I managed a group of predictive marketing but afterward I took a role in e-commerce where I managed emerging e-commerce technologies.

In 2010, I decided to look for an executive role that would allow me to combine my diverse skills to develop complex-quantitative technology solutions to solve complex-analytical problems in the financial markets.

What is the riskiest business decision that you’ve made?

The riskiest business decision I have made was to sign a multimillion-dollar agreement with AT&T to develop and launch the next generation of mobile banking and bill pay in the US market. There was an enormous competitive pressure at the time in financial services to develop the first mobile banking and bill-pay application; the technology solutions were not mature then and the mobile industry lacked a common standard. While making a decision to become the industry leader was very risky at the time, it was also one of the most rewarding experiences in my career as a bank executive. This decision gave me the opportunity to lead the market and bring mobile banking to millions of customers in the US.

Who would you consider an instrumental figure or mentor in your career and why?

My mother was a role model in my career. She was a very successful psychologist and university professor and taught me many lessons on how to balance career and family.

What has been a major turning point in your career?

After I obtained my PhD and decided to switch from working in a research field to financial services.

Tell me one thing people would be surprised to know about you.

I wrote a book titled Connecting My Dots, which provides advice to women on how to balance your career, family, and personal goals. Writing this book was the last opportunity I had to work with my mother. Together, we interviewed many successful women who shared their advice and wisdom with us. During an event at the Capitol Hill, I had the opportunity to present a copy of my book to the US secretary of labor Hilda Solis.

The banking industry has seen some peaks and valleys. Any advice for young professionals, especially young Latinas in your field?

I consider mentoring young professional women as one of my key contributions as a Latina executive in corporate America. Young women lack female role models in the quantitative-finance field so I take advantage of multiple opportunities through different employee mentoring programs at Bank of America to provide career advice to young women. Unfortunately, I have not seen many young Latinas selecting a career in this field.

I believe that while the number of women is the quantitative finance field is limited, the opportunities are endless. The quantitative field is quite challenging and the application to the financial markets is very interesting. However, science, math, and technology are growing fields in today’s global economy and an excellent opportunity for young Latinas to have a successful career. My main advice for young Latinas is to have a career plan, to persevere in achieving career goals, to not be afraid of taking risks, and to work with passion.

Get to know all of Hispanic Executive‘s “Best Of 2012” Recipients here.