CEO Soft Skills

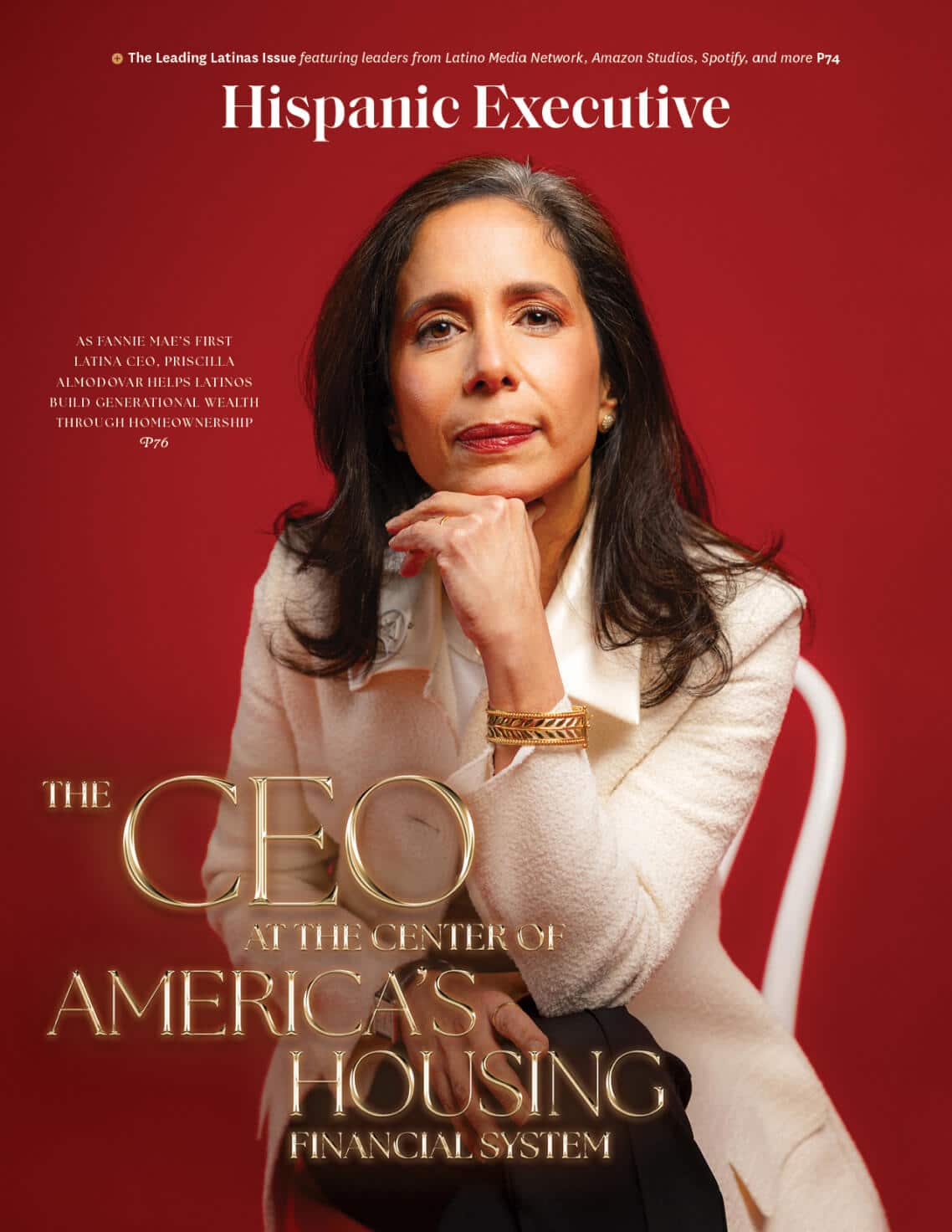

For instance, Almodovar set the roots for her career in the housing space over twenty years ago. She has been the president and CEO of Enterprise Community Partners, the managing director and co-head of real estate banking at JPMorgan Chase, and the president and CEO of the New York State Housing Finance Agency, the State of New York Mortgage Agency, and the Affordable Housing Corporation.

Each organization she helmed taught Almodovar how she could use her role, expertise, and ability to empower her team to create pathways for a new generation of homeowners.

“I think with everything in life, whether professionally or personally, you can’t do it alone,” Almodovar says. “It takes a lot of partnerships [and] it takes a lot of support . . . I personally get a lot of pleasure as a leader when I see my support elevate someone. I think it just keeps generating others to do the same.”

The cycle of mentorship and reverse mentorship is a cornerstone of Almodovar’s leadership style. She understands how it’s possible to create even more impact when you know who you can turn to for support and when someone knows they can also turn to you.

“I’ve been very fortunate to cultivate relationships that have stayed with me for twenty, thirty years,” the CEO says. “You tap them throughout [your career], and I think that allows them to counsel you because they get to know you, and you get to know them and their sensibilities.”

Almodovar adds that, at Fannie Mae, her approach to open communication and intentional mentorship at all levels opened up new avenues of innovation for the company’s culture and staff. An innovation which, culture leaders often note, is core to developing the more diverse, equitable, and inclusive workplaces of the future.

“I think there are leaders amongst all of us,” she says. “At my early town hall, I told the entire company: call me, give me your ideas, stop by. People took me up on it, but it was not the culture of the place. It’s a very collaborative and consensus-driven place, but it’s also very process-oriented as to how decisions get made and how communications are done. Here I was, someone who was very open to talking to everyone and seeing everyone, so the good news is I think the company has realized that it’s all just my desire to learn, to be able to serve the company, and to serve what we do.”