The Latino Wealth Journey

Understanding How to Expand Multigenerational Wealth Accumulation

Executive Summary

The Hispanic/Latino population has quadrupled since 1980 and represents more than 65 million people in the US with an economic output of $2.8 trillion and nearly 5 million businesses in the US, as reported in the Stanford Latino Entrepreneurship Initiative’s 2023 report.

“If you look at entrepreneurship, right, the highest rate is in the Hispanic community. Hispanics are not scared of risk. And that’s because if they’re here, they uprooted their life to America.”

According to Nielsen, 58 percent of US Hispanics are under thirty-four years of age, and 31 percent are under the age of seventeen. The average age for Hispanic/Latinos in the US is 33.7 years, which is well below 45.1 for non-Hispanics. As one of the youngest and fastest-growing minority groups, they are becoming the new majority minority in the US. Hispanic/Latino consumers are one of the most digitally active groups in the US and are prominent consumers who impact economic activities and growth.

In this report, we present findings from surveys of 623 High Net Worth and Emerging Affluent Hispanic/Latino individuals to assess the cohorts’ concept of wealth accumulation. By assessing the intersectionality between ethnicity, nativity, age, and education, this study addresses the financial journey to accelerate multigenerational wealth accumulation.

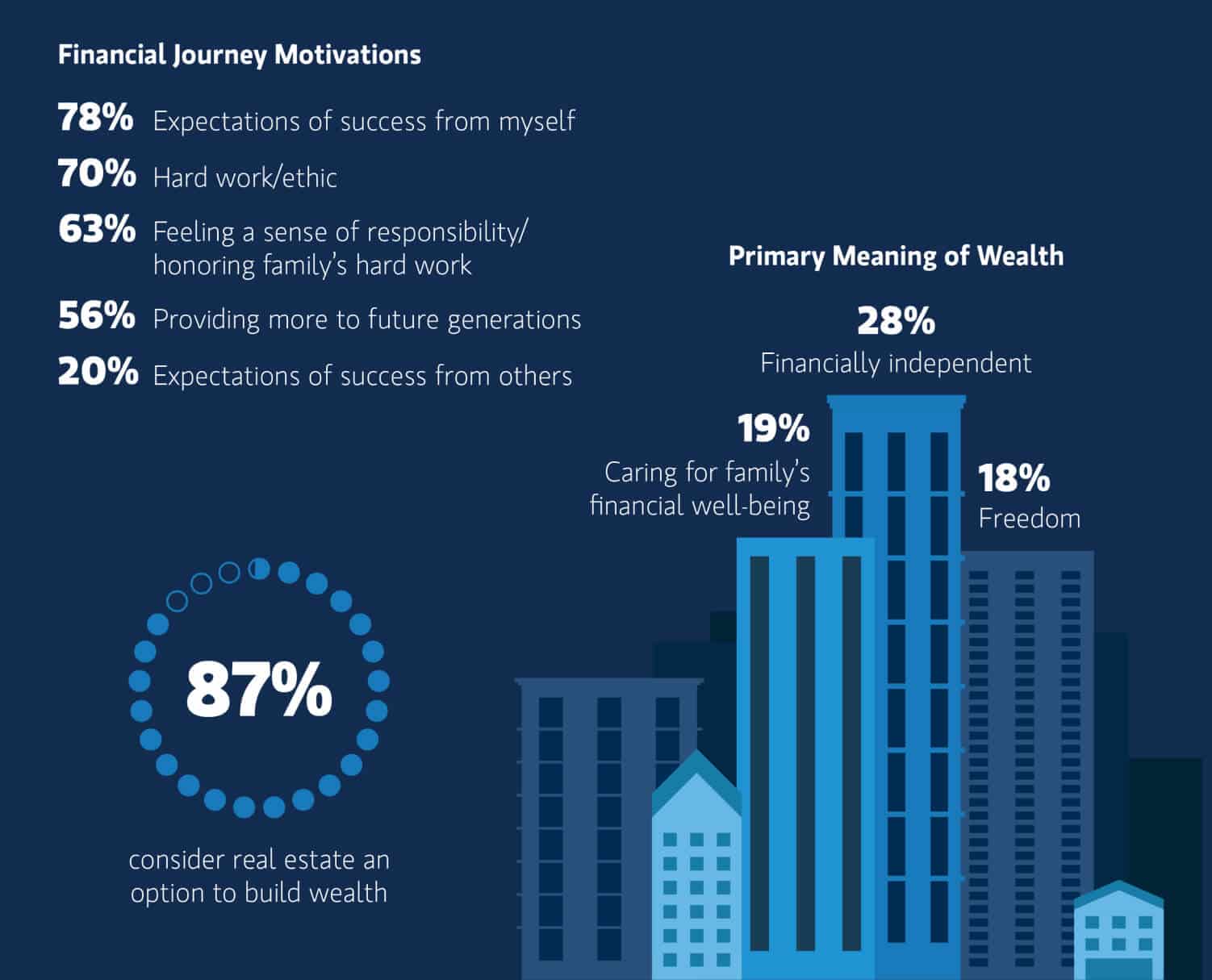

Hispanics/Latinos have increased their wealth year over year since 2019, and they are seeking to invest their future now to build multigenerational wealth sooner rather than later. Wealth can provide financial independence and helps create the freedom and stability to care for their family’s well-being.